A basic primer to help you understand the roles and responsibilities of all parties and to have clear expectations on the overall process.

Homeowners Insurance Claims

Homeowners Insurance Claims: When a homeowner experiences a sudden water damage event, like a pipe bursting and flooding part of the house or a tropical storm causing a roof leak, navigating the insurance claim process can seem overwhelming. Here’s a step-by-step guide that breaks down the roles, responsibilities, and actions of everyone involved, from the moment you place a call until the restoration work is complete.

1. Immediate Action by the Homeowner

- Stop the Water Flow: If caused by a pipe leak, the first step is to shut off the main water supply to stop further flooding.

- Call a Water Damage Restoration Company. Go with a local, reputable company that can respond quickly. No matter what an insurance company says, by law it is ALWAYS the homeowner’s choice over who they want to respond to the home emergency. Insurance companies can give recommendations, but cannot force you to use their company.

Be careful about working with an insurance company’s “preferred vendors”, these are typically large, national Restoration companies that have special relationships with insurance companies. The company you choose to conduct the water damage mitigation needs to be independent because they are working on YOUR behalf, not for the insurance company. - Call the Insurance Company: Contact your insurance company’s claims department as soon as possible. Provide details about the incident, including when it occurred, the extent of the damage, and what caused it.

- Document the Damage: Take photos or videos of the affected areas before any cleanup begins. This documentation is crucial for your insurance claim.

2. Filing the Homeowners Insurance Claims

- Initial Call: During your call to the insurance company, you’ll report the incident and initiate a claim. The insurance company will provide a claim number, which will be used for all future communication about this case.

- Assigning a Claims Adjuster: The insurance company will assign a claims adjuster to your case. The adjuster’s role is to assess the damage, determine the cause, and estimate the cost of repairs.

3. Mitigation Work Begins

- Mitigation Work Begins: The mitigation company’s role is to minimize further damage by stabilizing the environment. They will do this even without an approved claim or estimate as long as they have a Work Authorization signed by the homeowner.

The process of getting a claim approved and then an estimate approved can take weeks, which would lead to far more damage to the home if mitigation was not performed. For this reason, Restoration Companies will perform mitigation damage work and then write the estimate for the insurance company later.

. This often involves:- Extracting standing water.

- Drying out the affected areas using industrial fans and dehumidifiers.

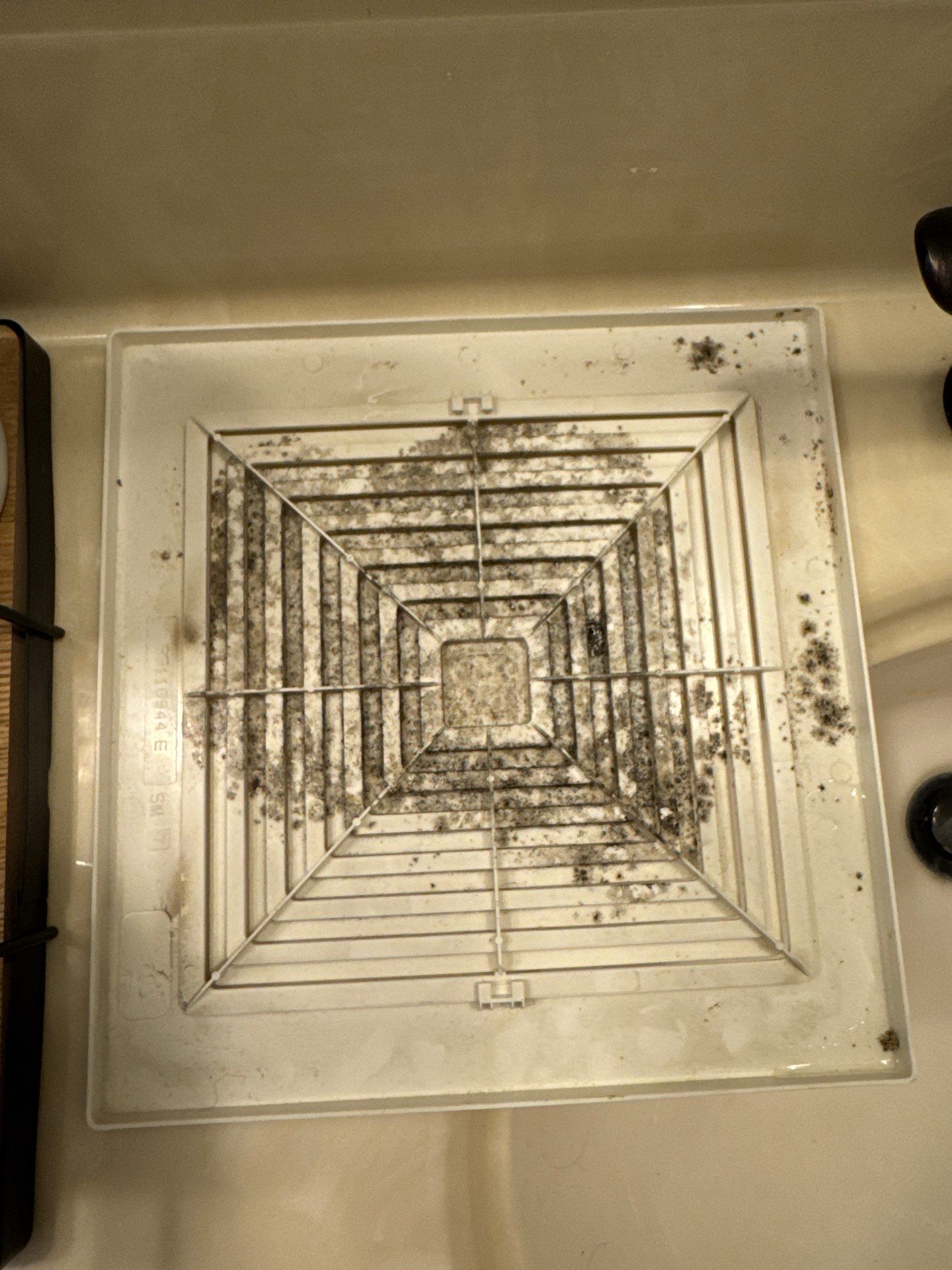

- Removing damaged materials, such as wet drywall or flooring, to prevent mold growth.

- Documenting all work done, including the scene as it was found, the discovered extent of damage and steps taken to mitigate.

- Communication with the Adjuster: The mitigation company will also attempt to coordinate with the insurance adjuster to ensure the work aligns with the insurance company’s expectations. However, as preventing further serious damage to your home is the mitigation company’s number one priority, they will take action to stabilize the scene upon your approval.

4. Assessment and Estimates for Homeowners Insurance Claims

On-Site Inspection from Adjuster.

- Initial Visit by the Adjuster: Once the insurance company has been notified and a claims adjuster is assigned, the adjuster will schedule a visit to your home. During this visit, the adjuster will inspect the damaged areas to assess the extent of the water damage, verify the cause, and evaluate the scope of the mitigation work already performed.

- Documentation: The adjuster will take their own photos, measurements, and notes to create an accurate record of the damage. This documentation is crucial for creating their estimate of the repair costs.

- Preparation of the Estimates: The adjuster will prepare 2 estimates. The first will be for the mitigation and drying of the damage. This will also include the cost of moving your household furniture and temporary lodging, if required. The second estimate is the estimate for the reconstruction of the damaged property.

Mitigation Company’s Estimates

- Preparation of the Estimates: The mitigation company, such as Home Disaster Medics, will also prepare their own detailed estimate of the mitigation work needed or already performed. This estimate includes the cost of water extraction, drying, removal of damaged materials, and any other necessary steps to prevent further damage, such as mold remediation. Some full-service restoration companies, like Home Disaster Medics, will also prepare a reconstruction estimate for the work needed to put your home back in order.

- Submission to the Insurance Company: The mitigation company submits their estimate directly to the insurance company, usually via the claims adjuster. This is an important step because the mitigation company has firsthand knowledge of the damage and the specific work required to address it. This is also where it pays to have an independent company working for you. Oftentimes a good and experienced Restoration Company will identify scope of work that was missed by the adjuster but which the homeowner is entitled to; thus ensuring that your home damage is fully covered by your claim.

Reconciliation of Estimates

- Comparison of Estimates: The insurance adjuster will compare their estimate with the one provided by the mitigation company. Discrepancies can sometimes arise between the two estimates due to differences in scope, pricing, or understanding of the necessary work.

- Negotiation and Coordination: The mitigation company typically takes the lead in coordinating with the adjuster to reconcile any differences. They will explain and justify the specific tasks and costs outlined in their estimate. This may involve providing additional documentation, like moisture readings, or detailed descriptions of the damage to support their claim.

- Advocacy for the Homeowner: During this process, the mitigation company acts as an advocate for the homeowner, ensuring that the insurance adjuster understands the full scope of the damage and the work required to mitigate it. Their goal is to ensure that all necessary mitigation work is covered by the insurance policy and that the homeowner is not left with unexpected out-of-pocket expenses for work that should be covered.

Approval of Costs

- Final Approval: Once the adjuster and the mitigation company reach an agreement on the scope and cost of the mitigation work, the insurance company will approve the costs. This approval is crucial because it determines how much of the mitigation work will be covered by the insurance policy. Anything which isn’t covered is the homeowner’s responsibility.

- Payment Process: The insurance company may issue payment directly to the mitigation company or to the homeowner, depending on the arrangements made. This payment is usually handled separately from the payment for the subsequent restoration work.

Why Homeowners Insurance Claims Process Matters

- Ensuring Accurate Coverage: By submitting their own estimate and working closely with the adjuster, the mitigation company helps ensure that all necessary work is recognized and covered by your insurance policy. This minimizes the risk of coverage gaps that could leave the homeowner responsible for additional costs. By acting on behalf of the homeowner, the mitigation company helps streamline the process and ensures that the homeowner’s interests are protected throughout the claims process.

- Reducing Stress for the Homeowner: The mitigation company’s coordination with the adjuster takes much of the burden off the homeowner. The homeowner doesn’t have to navigate the complexities of the insurance process alone; instead, they have a professional advocating on their behalf to ensure the claim is handled accurately and fairly.

5. Approval and Payment for Mitigation Work

- Approval of Costs: The insurance company will review the adjuster’s estimate and approve the costs for mitigation. The company might pay the mitigation company directly, or they may reimburse you if you’ve paid upfront.

- Payment: The payment for mitigation work is typically handled separately from restoration work. Since mitigation is about preventing further damage, it is often prioritized for quicker approval.

6. Restoration Work

- Restoration Company Selection: After mitigation is complete, you can hire a restoration company to begin repairs. Sometimes, as is the case with Home Disaster Medics, the same company that handled mitigation can also do restoration.

Sometimes a homeowner may choose to have the Restoration company do a portion of the restoration but do other work themselves or by hiring other contractors. - Restoration Process: This involves:

- Repairing or replacing damaged materials (drywall, flooring, cabinetry, etc.).

- Painting and finishing work to restore your home to its pre-loss condition.

- Coordination with Adjuster: The restoration company will also communicate with the insurance adjuster, especially if there are changes in the scope of work.

7. Finalizing the Homeowners Insurance Claims

- Inspection and Completion: Once the restoration is complete, the insurance adjuster may do a final inspection to ensure all work was done to their satisfaction.

- Payment for Restoration: Like mitigation, the insurance company will issue payment for the restoration work. This could be directly to the contractor or to you, depending on the arrangements made.

- Closing the Claim: After all work is completed and payments are made, the insurance company will close the claim.

8. Out-of-Pocket Expenses

- Deductible: Remember that you are responsible for paying your insurance deductible, which is the amount you agreed to pay out of pocket before your insurance coverage kicks in.

- Additional Costs: If you choose upgrades or repairs beyond what was damaged (like upgrading flooring), those costs are typically not covered by insurance. Additionally, sometimes an insurance company will not pay for work which was completed. It is the homeowner’s responsibility then to pay the contractor and seek restitution from the insurance company through appeal, arbitration or small claims court.

Understanding these steps can help you feel more confident and in control during what is often a stressful situation. Each party plays a crucial role in ensuring your home is restored quickly and efficiently while adhering to your insurance policy.

Follow Home Disaster Medics on Facebook