Empowering Home Owners in Holly Ridge

Empowering Home Owners in Holly Ridge: Dealing with home damage can be tough, but understanding how to navigate the insurance claim process is key to getting the compensation you deserve. At Home Disaster Medics, we specialize in helping homeowners in Eastern North Carolina recover from damage and maximize their insurance claims.

Here are some essential dos and don’ts to keep in mind when filing your claim.

Dos for Empowering Home Owners in Holly Ridge:

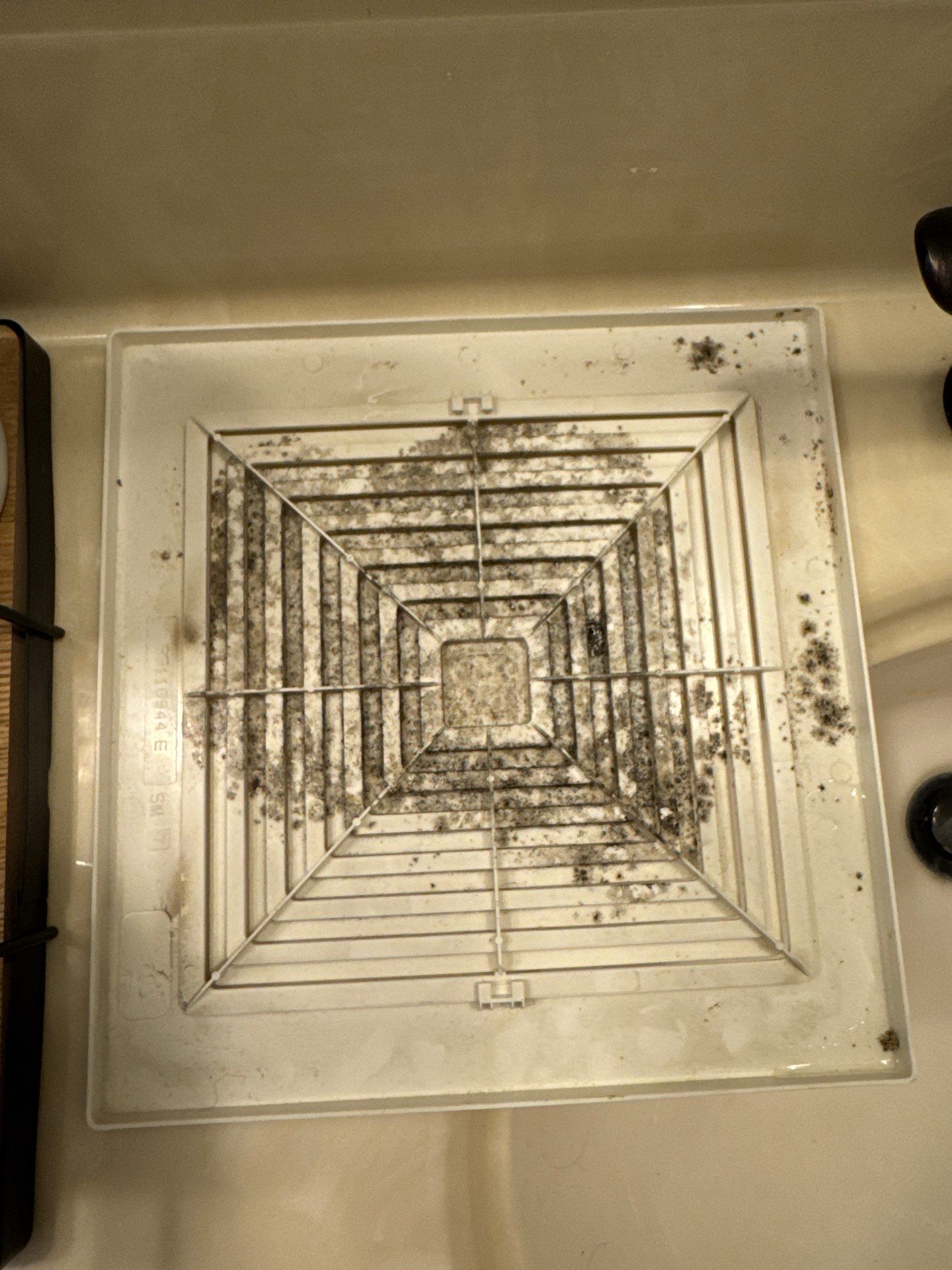

Document Everything: Take clear photos and videos of the damage before making any repairs. Capture the extent of the damage from different angles and keep detailed records of all communication with your insurance company.

Act Quickly: Notify your insurance company as soon as you discover the damage. The sooner you act, the quicker the claims process can move forward, and it helps prevent further issues.

Mitigate Further Damage: Take reasonable steps to prevent additional damage. This might include covering holes with tarps, boarding up broken windows, or shutting off utilities if necessary.

Review Your Policy: Familiarize yourself with your insurance policy. Know what’s covered, any exclusions, and deadlines for filing claims to avoid missing out on compensation.

Hire a Professional: Consider hiring a reputable contractor or restoration service like Home Disaster Medics to assess the damage and provide an estimate. Professionals can help ensure that all damage is properly documented for your claim.

Keep Records of Expenses: Track all costs related to the damage, including repairs, temporary housing, and any additional living expenses you incur due to the situation.

Advocate for Yourself: Don’t hesitate to stand up for yourself if you feel your claim is being unfairly denied or undervalued. Gather evidence and documentation to support your case and be persistent in following up with your insurance company.

Don’ts for Empowering Home Owners in Holly Ridge:

Wait Too Long to File: Delaying your claim can lead to missed deadlines or complications. Act promptly to avoid unnecessary delays or denials.

Discard Damaged Items: Avoid throwing away damaged items until your insurance company has had a chance to assess everything. Keeping these items can help support your claim.

Accept the Initial Offer Without Question: Insurance companies may start with a lower settlement offer. Don’t be afraid to negotiate or seek a second opinion if you feel the offer doesn’t cover your repair costs.

Overstate the Damage: While it’s important to accurately document the damage, avoid exaggerating. Stick to the facts and provide solid evidence to back up your claim.

Neglect Regular Maintenance: Keeping up with home maintenance can help prevent damage and strengthen your claim in case of disputes. Failing to maintain your home might give the insurance company a reason to deny your claim.

Sign Anything Without Understanding: Read through any documents or agreements from your insurance company before signing. If you have questions, seek clarification from your agent or a legal professional.

Give Up: Navigating insurance claims can be frustrating, but don’t lose hope if your claim is denied or undervalued. Explore options for appeal, and consider consulting a public adjuster or legal counsel if needed.

At Home Disaster Medics, we understand how vital it is to maximize your insurance claim so you can receive fair compensation for home damage. Our experienced team is here to guide you through every step of the claims process, helping you get back on your feet as quickly as possible. Contact us today for expert assistance with your insurance claim and restoration needs!

Follow Home Disaster Medics on Facebook